does tennessee have inheritance tax

Attorneys with you every step of the way. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early.

State Death Tax Hikes Loom Where Not To Die In 2021

Where you live can help or hinder your ability to make ends meet.

. The most common reason for using a Deed of Variation is to avoid a large inheritance tax bill. The property tax freeze program is available for homeowners 65 and older who meet income qualifications. The United States of America has separate federal state and local governments with taxes imposed at each of these levels.

Tennessee has no inheritance tax or estate tax. Weighing the tax landscape against your financial picture lets you stretch your dollars. Twelve states and Washington DC.

Inheritance and Estate Taxes. Inheritance and Estate Taxes. Our network attorneys have an average customer rating of 48 out of 5 stars.

There are six as of 2022. Impuesto de sucesiones in Spain is the inheritance tax that you must pay for the transference of goods. Tennessee Sales Tax.

Pennsylvania does have an inheritance tax that ranges from 45 to 15. Maryland is the only state to impose both. Russia abolished inheritance tax in 2006 but have fee with rates of 03 but no more than 100 000 rubles and 06 but no more than 1 000 000 rubles.

The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. An ebook short for electronic book also known as an e-book or eBook is a book publication made available in digital form consisting of text images or both readable on the flat-panel display of computers or other electronic devices.

The assets in a revocable trust are still yours and you will pay taxes accordingly. Passing on a home. Get your tax refund up to 5 days early.

View a printable version of the whole guide. The availability of legally recognized same-sex marriage in the United States expanded from one state Massachusetts in 2004 to all fifty states in 2015 through various court rulings state legislation and direct popular votes. The empty string is the special case where the sequence has length zero so there are no symbols in the string.

Have you inherited a 401k plan. The amount of Social Security and other retirement benefits available to. Attorneys with you every step of the way.

Those who handle your estate following your death though do have some other tax returns to take care of such as. You wont have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income but the type of property you inherit might come with some built-in income tax consequences. Exempt Tennessee Real Property Taxes.

Get the right guidance with an attorney by your side. Find Your Institution See what resources your library currently offers. The inheritance tax is paid out of the estate by the executor.

Last Wills Last Will State Requirements Living Trusts Living Wills Estate Planning Basics Inheritance Cases. The required maximum income level varies by county ranging from 31600 to 56790. Understanding the various considerations involved can help minimize your tax liability and maximize your May 02 2022 4 min read.

Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the baseline rates until 2025 when the tax will be fully eliminated. Another important difference between revocable and irrevocable trusts comes with taxes. We offer many other periodical resources and databases that have been recently enhanced to make discovery faster and easier for everyone.

People you give gifts to might have to pay Inheritance Tax but only if you give away more than 325000 and die within 7 years. A myriad of taxesproperty license state and local sales property inheritance estate and excise taxes on gasolineeat away at your disposable income. Inheritance tax in Spain.

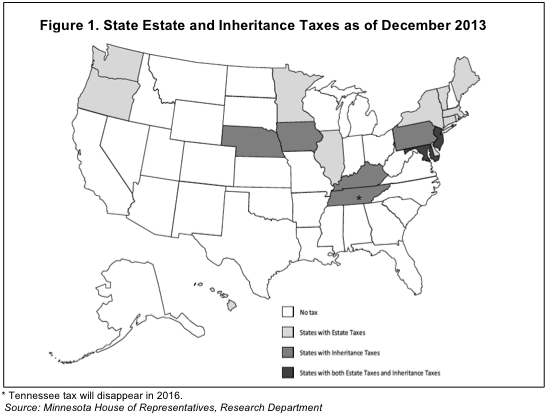

States each have separate marriage laws which must adhere to rulings by the Supreme Court of the United States that recognize marriage as a fundamental. Tennessees estate tax was repealed effective January 1 2016 and Indianas inheritance tax which was supposed to be phased out by January 1 2022 ended up being. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

In Tennessee judges divide marital property along the lines of equitable distribution which is not necessarily equal but takes into account each spouses needs and means. Find out what an inheritance tax is whether your state has one and if so how much you might have to pay. Impose estate taxes and six impose inheritance taxes.

In Tennessee the median. Our network attorneys have an average customer rating of 48 out of 5 stars. Tennessee doesnt have an inheritance or estate tax.

Heres a roundup of the highest and lowest taxes by state. Protect your brand. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be.

Federal estatetrust income tax return. If someone dies leaving their entire estate to their partner then when the other spouse dies the family members may be left with a large inheritance tax bill as the first spouse will have effectively wasted their nil-rate band. Each due by tax day of the year following the individuals death.

Additional local taxes may apply Clothing. In fact your revocable trust will have the same Social Security number as you. Abolished estate tax in 2008.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate. Explore Content Preview millions of articles or search topics to discover new connections. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

For instance a judge will consider the tangible contributions to the marriage made by each party. In formal treatments the empty string is denoted with ε or sometimes Λ or λ. Protect your brand.

There is only one empty string because two strings are only different if they have different lengths or a different sequence of symbols. In 2021 rates started at 108 percent while the lowest rate in 2022 is 116 percent. That includes any income taxes inheritance taxes or estate taxes.

Taxable 4 state rate. Which states have an inheritance tax. For additional information see Tennessees Tax Freeze page.

Final individual federal and state income tax returns. Watch CNN streaming channels featuring Anderson Cooper classic Larry King interviews and feature shows covering travel culture and global news. Tennessee is an inheritance tax and estate tax-free state.

For example if you inherit a traditional IRA or a 401k youll have to include all. Taxes are levied on income payroll property sales capital gains dividends imports estates and gifts as well as various feesIn 2020 taxes collected by federal state and local governments amounted to 255 of GDP below the OECD average of 335 of. Last Wills Last Will State Requirements Living Trusts Living Wills Estate Planning Basics Inheritance Cases.

Although sometimes defined as an electronic version of a printed book some e-books exist without a printed equivalent. Get the right guidance with an attorney by your side. Inheritance and Estate Taxes.

State Income Taxes and Federal Income Taxes.

State Estate And Inheritance Taxes Itep

Is There A Tennessee State Estate Tax Mendelson Law Firm

Chambliss 2014 Estate Planning Seminar Pptx

Do I Have To Pay A New York Inheritance Tax If My Parents Leave Me Their House Long Island Ny Estate Planning Attorneys

Does Tennessee Have An Inheritance Tax Crow Estate Planning And Probate Plc

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Tennessee Taxes Do Residents Pay Income Tax H R Block

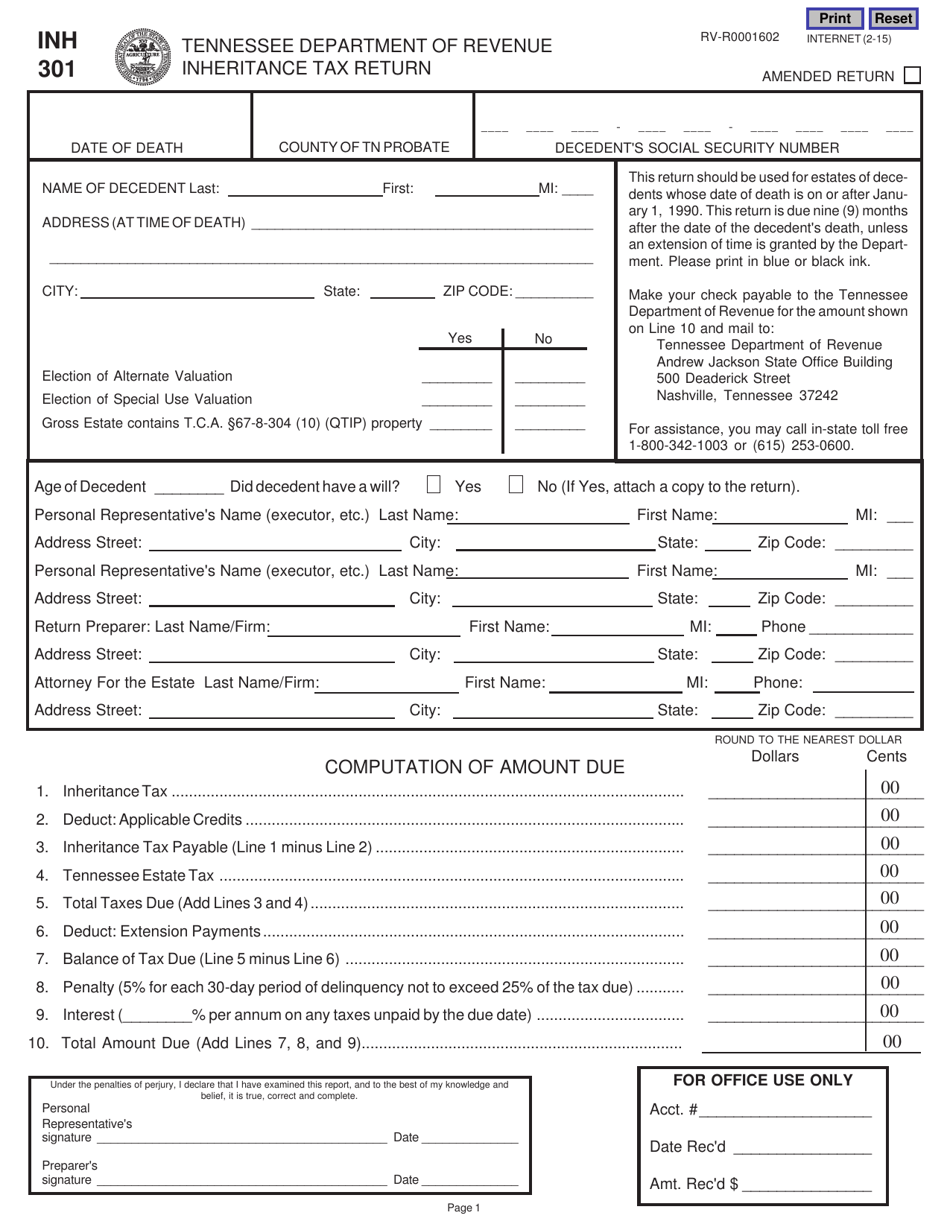

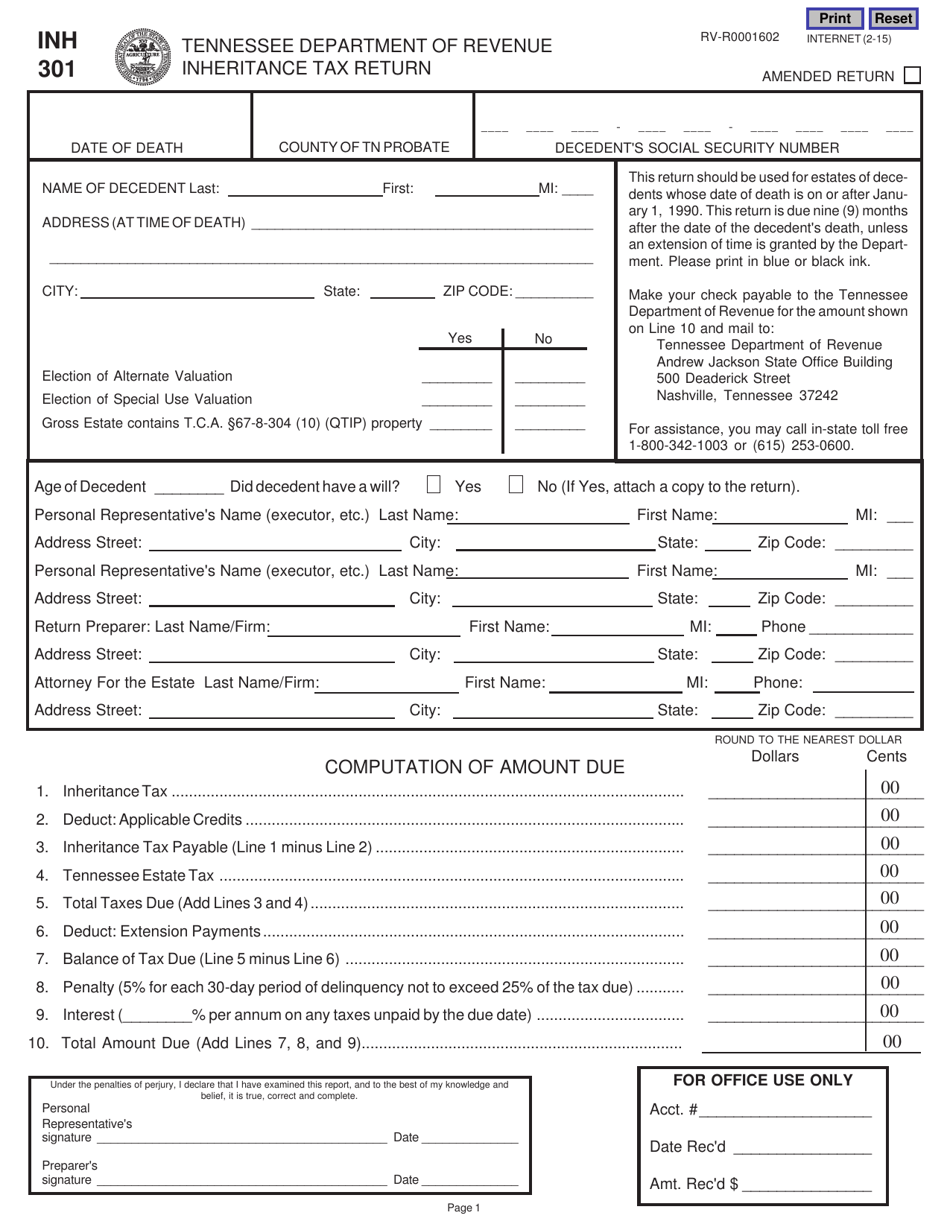

Form Rv R0001602 Inh301 Download Fillable Pdf Or Fill Online Inheritance Tax Return Tennessee Templateroller

Fill In State Inheritance Tax Return Short Form

Tennessee State Tax Guide Kiplinger

Tennessee Inheritance Tax Cut Impact In Question Nashville Business Journal

Tennessee Health Legal And End Of Life Resources Everplans

Free Tennessee Last Will And Testament Template Pdf Word Eforms

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Tennessee Inheritance Laws What You Should Know Smartasset

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Farmers Cry Foul Over Biden S Death Tax Proposal Tennessee Star

What Happens If You Die Without A Will In Tennessee Epstein Law Firm Blog